Customer relationship management is essential in the financial planning service industry. There’s a lot at stake, and ensuring that your clients trust you is paramount.

Are you wondering what is Customer Relationship Management and why it matters? Check out our CRM guide.

Unfortunately, there are a lot of ways that a financial advisor-client relationship can go wrong: a misplaced figure, a neglected agreement, a missed appointment, or a promised discount that goes undelivered. Each of these can erode the faith that is necessary for a customer to continue trusting you with their money.

Time to enact ritual sacrifice in the hopes of appeasing the Gods of Finance, right?

Uh, maybe. That’s up to you (though we hear white calves are harder to find than they used to be). A better approach, however, would be to implement an effective system for managing client needs – which is where a CRM solution comes in.

CRMs, or customer relationship management systems, can help you streamline your workflow so that clients’ needs stay top of mind, without you having to remember each and every detail. A CRM’s ease of use means you can simply plug important dates, customer details, and sales information into your system, and then forget about them until you need them.

Gone are the days of being a computer; now you can put computers to work for you.

Finding a great CRM for financial advisors is easier said than done, of course. While there are a wealth of potential choices (yay!), there are so many to choose from that many people get bogged down in the search (boo). If you want a specifically tailored CRM for financial advisors, you have to know where to look.

We’ve got some good news for you: Close is here to help. Today, we’re going to discuss the best CRMs for financial advisors, the pros and cons of each, pricing, and more. After you compare them to determine which will best meet your needs and choose your top candidates, you can enjoy a free trial to really get a feel for the software.

Or, if you feel certain of your choice, you can jump right in… which is what we’re about to do. Read on!

What is a CRM System, and What Can it Do for Financial Services?

Before we talk about which systems are best, let’s tackle one of the most common questions we get. What is CRM software for financial advisors, and how is it different from other client management tools?

While there exist any number of answers to this question, the two most important tactics your CRM needs to enable are increasing your client base and lengthening your relationships with them. Let’s take a closer look.

Explore the possibilities of contractor CRMs and its impact on your workflow.

Increasing Your Total Number of Clients

Imagine that you developed a fintech app and you want to be successful, sell more products, and bring more business in, you need more client relationships. It’s a very simple equation and one with which a CRM can definitely help.

Whether you work largely on cold calls, emails, referrals, or all of the above, you need a place to store and access client information as you conduct your business processes. That includes leads and prospects, both critical stages in the buyer journey.

If you fail to manage them as carefully as your clients, you won’t convert nearly as many. For obvious reasons, that will prevent you from achieving your goals of getting more clients in the door.

Building Longer-Lasting Relationships with Existing Clients

The second of a CRM’s key features is a suite of wealth management tools for existing clients. That means tracking what you do for them: their goals, your services, their gains and losses, and your communications.

The good news? There’s no need to track all of these metrics across innumerable spreadsheets (because we know how much you love doing that). A high-quality and comprehensive CRM will allow you to do everything from one dashboard, creating a robust client profile that allows you to serve them even more effectively.

A few more of the features you should look for in a wealth management or financial services CRM include:

- CRM platform onboarding and ongoing support (ideally provided in real-time)

- Workflow automation tools for building and maintaining your sales pipeline

- Phone and email follow-up prompts, scripts and templates

- Automated sales outreach sequences

- Audience segmentation

Below, we will take a look at some of your options for finding the best CRM software for financial advisors. Whichever you choose, be sure to keep the above factors in mind.

Benefits of Using Financial CRM Software

Let’s say, for the sake of argument, that you’re good at keeping lists in your head. Your sales figures are just fine, thank you. You pride yourself on knowing your leads and clients inside and out, and you don’t think you need A Whole Thing to keep doing your job well.

And you know what–from a numbers perspective, you don’t. Your processes are working. You’re an excellent salesperson, and you’re hitting your goals. You rock at cultivating new leads, providing customer support, and knocking out time-consuming tasks with confidence.

But what if your sales processes could improve yet more, and you could bring in more clients while keeping existing clients with you longer? Wouldn’t that be worth it?

We’re guessing, for most people, that the answer is yes. From document management to improving your customers’ user experience with your products and services, a CRM helps in many ways. Here are some of the top benefits of using a CRM in financial services and wealth management.

- Manage leads and pipeline: Pipeline management is all about tracking your current clients and customers and bringing in new ones, which is why lead management is so important.

- Improve sales processes: By tracking and segmenting your contacts, you can increase the number and frequency of touchpoints and close more deals.

- Manage tasks: With checklists, scripts, and sales automation, you’ll get more done and track it all more effectively with task management software.

- Assist team members: Good CRM software should also allow you to coach your sales team remotely, from call training to managing quotas.

- Automate marketing: From templates to workflows, you’ll do a lot less work reaching out to your leads and see a lot more ROI from your marketing automation efforts.

- Boost revenue: Together, the above capabilities will help you boost your revenue overall. Here are some case studies to prove it.

9 Best CRMs for Financial Advisors in 2023

When it comes to CRMs for financial advisors, the list is long. However, the list of CRMs you’d want to use is quite a bit shorter. Whether you’re looking for customer relationship management systems to organize your contacts, generate new clients and leads, provide sales script templates, or boost your team’s sales motivation, you’ll need a good CRM with a proven track record.

From small business enterprises to large advisory firms, you need a SaaS provider that provides excellent contact management, segmentation, sales pipeline prompts, and more. The following list of CRMs is a good place to start.

1. Close

|

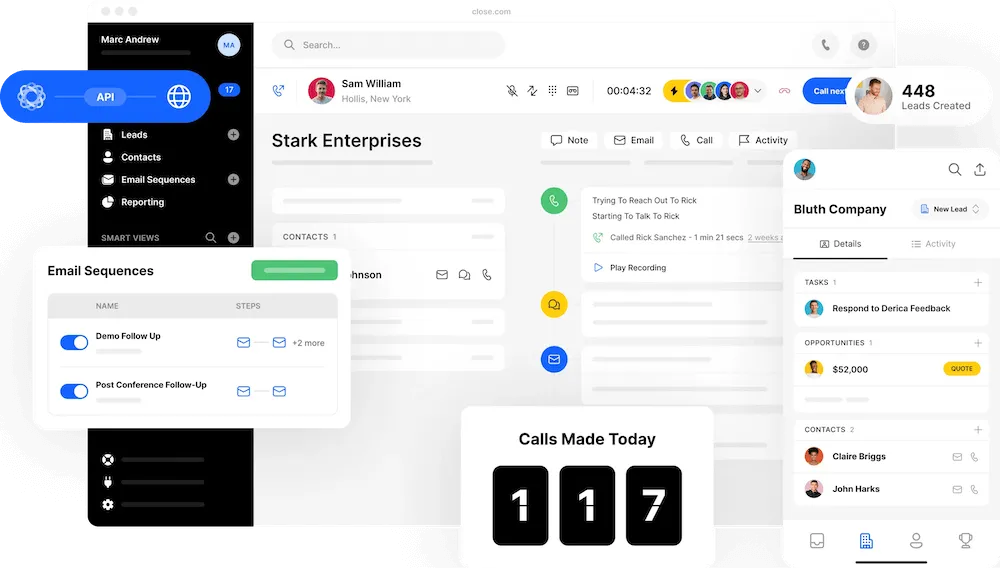

Close is one of the most popular all-in-one choices for users who need a ton of functionality backed by a clean user interface and robust tools and integrations.

Pros:

Close is an actual one-stop shop. Unlike many other CRMs, which promise tons of services under one umbrella but actually mean they offer integrations, Close really does offer a huge variety of services within its software. These include email, calling, social media, call training, communication templates, and integrations to connect with the third-party software you already use, like Outlook, Gmail, or other favorite tools. And yes, there is a mobile app.

Notably, Close's commitment to accessibility extends to its mobile app, enabling users to stay connected with prospects and customers on-the-go. The mobile app empowers sales representatives with the flexibility to manage leads, respond promptly to inquiries, and keep in touch with clients, regardless of their location. Whether in the office or traveling, the mobile app ensures that sales professionals never miss a beat.

|

And while it’s nice to talk up your own features, it’s nicer to provide proof. The Close platform has proven itself over the past decade with businesses of all shapes and sizes using it to easily track more prospects and win more deals. Plus, our personalized approach provides fast and friendly customer service and answered questions every time.

Cons:

While other CRMs offer a complimentary ‘free’ tier for a limited number of users, Close does not. Our free trial provides 14 days of access, providing time to get yourself set up and feel out the software. Still, many small businesses want a no-cost option.

2. Zoho

|

Zoho CRM is one of the most popular on the market. It is affordable, easy to use (though not necessarily to tailor), and comes with a thorough step-by-step guide for installation.

Pros:

One of Zoho’s major pros is its pricing. Because they have tiered options, it is quite affordable for small and medium-sized businesses. Plus, its user interface is simple and intuitive, making your job easy when you go to look up information or engage in marketing activities.

If you don’t need much customizing, then you might find it the perfect option.

Cons:

Many users say that Zoho is hard to customize and harder to scale. Despite its clean user interface, it’s not a good out-of-the-box product for users who aren’t already experts in the use of CRMs, so you won’t be able to get it up and running in a day.

On the other hand, for companies that have a lot of staff needing to use it, it might not provide the best service due to the lag in setup.

3. Salesforce Financial Services

|

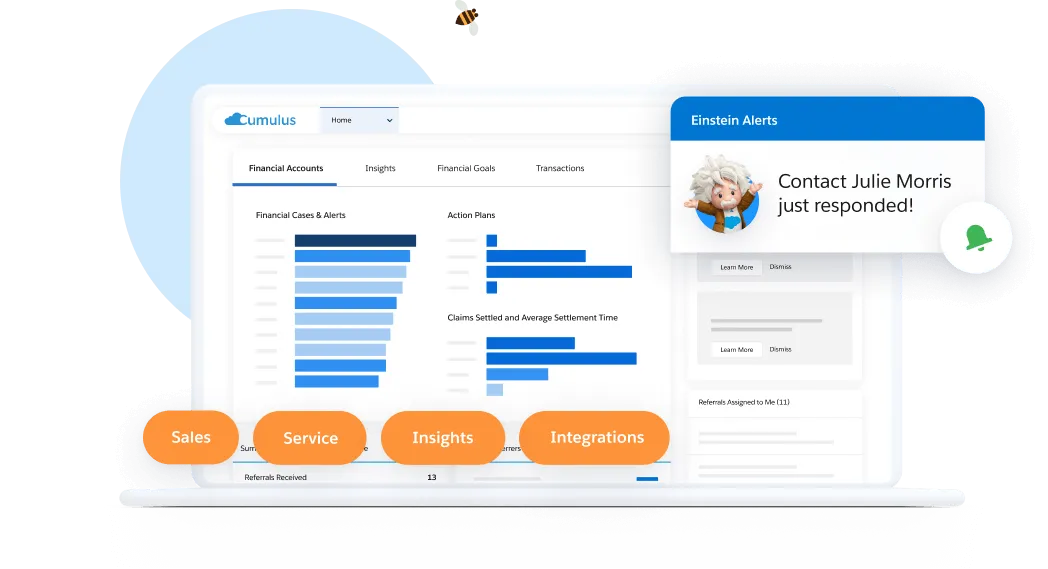

Building on the great reputation Salesforce has built over the years as a marketing engine par excellence for companies of all kinds, the SaaS is back with a CRM designed specifically for financial advisors.

Pros:

Because Salesforce has such a long history (founded in 1999), they’ve got plenty of experience backing their products. Today, their system is incredibly comprehensive and integrates well with all kinds of other software you might already use.

Users report that it is a simple matter to look up contact information and automate your pipeline – once you get everything set up, that is. They do offer specialists to help train you on the software and support you as you go along.

Cons:

Many users complain that Salesforce has a high turnover for its customer service staff in particular. That can make it hard to get questions answered and slow down the product’s effectiveness overall.

Also, this might not be the best choice for companies that have never used a CRM before. If you’re just starting out, or if you’ve used only simple customer resource management systems to date, it’ll take a significant amount of time to plan out your processes and put them all in place with Salesforce, just because the platform is so incredibly large.

4. Wealthbox

|

While other CRMs are designed for a more multipurpose business approach applicable to any industry, Wealthbox was designed specifically for the finance industry.

Pros:

Wealthbox is specifically designed for financial planners and brokers. Given that is its only purpose, it is perhaps the most financially tailored product on our list. They also have a long list of financial planning partners with whom they integrate, so their specialty options are significant.

Customers compliment them for a simple user interface and all the functions needed to operate a financial planning firm of any size, and for a relatively low setup time.

Cons:

Wealthbox doesn’t offer anything different from the other CRMs in this list, you can just expect to put in the time to customize it. Combined with the fact that their users report frequent crashes and limited updates, especially for the mobile app, many people opt to look elsewhere for financial planning CRMs.

5. Ugru

|

Another platform designed to meet the needs of financial planning firms and independent advisors, Ugru has a lot of specialty features that make automation, marketing, and sales easier.

Pros:

Ugru prides itself on deleting double entries, which makes it easier for your CRM to collect and collate customer information without duplicating it. That way, you’re not spamming your leads and prospects, which can lead to failed relationships and missed sales targets.

With more than 40 predesigned workflows specifically created for finance experts, you’ll find it has good out-of-the-box outcomes for users. Its client portal, templates, and large storage capacity increase its user-friendliness further.

Cons:

Ugru’s basic plan cost is more than double that of a CRM like Close and contains little in the way of additional features. Although their pricing includes 3 users, you don’t have the option of getting it for only one person. For that reason, it’s a poor choice for independent contractors or sole proprietors.

Another thing customers report being unhappy with is the inability to retrieve something that got deleted. Should you accidentally trash a piece of customer information, a profile, or a contact, you might be SOL.

6. NexJ Systems

|

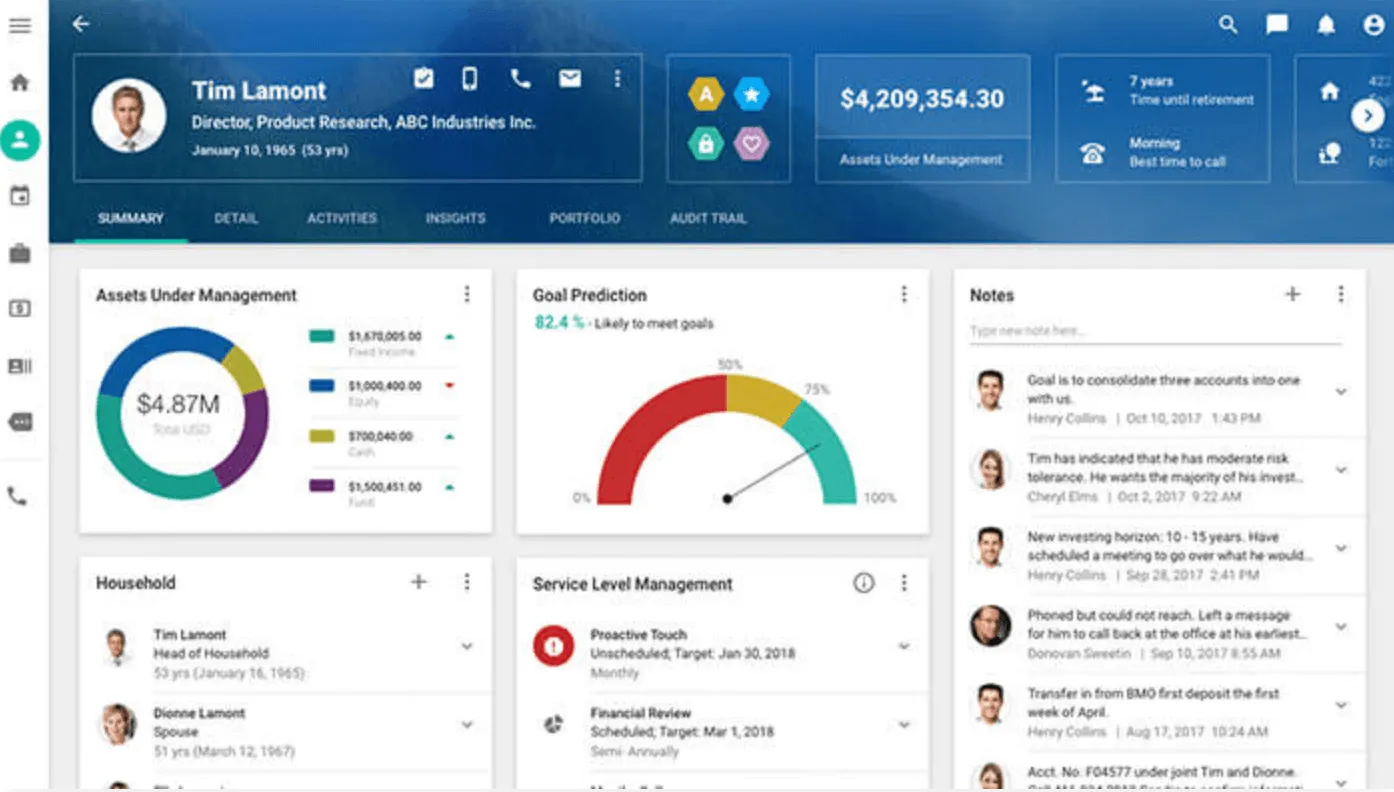

With a wide range of wealth management and banking solutions, NexJ Systems might prove the best option for huge enterprises such as banks or multinational firms. However, you’re going to need the budget to back that up.

Pros:

Billing themselves as the pioneers of “intelligent customer management,” NexJ Systems is a CRM that has a lot of potential depth for wealth managers. Among their pros are a thoroughly comprehensive dashboard and lots of integration potential, as well as a responsive customer service team.

They also have an impressive list of clients, including such notables as American Family Insurance and Wells Fargo Advisors. While that speaks largely to their success, it also speaks to the kinds of budgets required to bankroll NexJ at your company.

Cons:

The con for NexJ that jumps out immediately is the fact that it is impossible to find pricing on their website. They direct you to contact them or book a demo to learn more, which means you’re guaranteed to feel some sticker shock when you first see that quote. Whether or not it’s worth it to you is something you’ll have to decide then.

7. DebtPayPro

|

Some financial service providers have a more specific niche than others. For those who focus on debt consolidation and payment, DebtPayPro is a good contact management option.

Pros:

If you’re a company that looks for debt consolidation or payment plan customers, you need a CRM that can back up your specific process. Your target customers are quite a niche, which means you need sales software, scripts, and functionality that fits into that niche – which DebtPayPro does. It helps you prospect, capture leads, and bucket them, all with a debt-based focus.

Cons:

If you’re not a financial company focusing on payment or consolidation of debt, this likely isn’t the program for you. If you are not a debt company, then their specialized functions will most likely get in the way.

Additionally, their pricing is suspect. You have to watch a demo or contact them to learn more, which says they likely won’t prove that affordable for the average bear.

8. Redtail

|

Designed for small teams of agile marketing and sales professionals, Redtail CRM is a good choice for small and medium-sized businesses.

Pros:

Not for nothing did Redtail make the list for Forbes Advisor's Best CRMs of 2022. It is specifically tailored for finance professionals, with a straightforward dashboard and not a lot of setup required for it to become functional for sales teams.

With database migration, reporting, and other sales functionality, you can make the jump to Redtail pretty simply as well. Many reported liking its native calendar too.

Cons:

Users report that Redtail support is not ideal. They have sometimes glitchy integrations and even their own functions don’t update effectively enough for it to be a worthwhile system for some finance experts. Other users report that its appearance is out of date and the dashboard isn’t that easy to use.

9. AdvisorEngine

|

Last on our list is AdvisorEngine, formerly Junxure, which provides the standard services of email marketing, calling, contact management, and more, all built by financial advisors for financial advisors.

Pros:

One of the qualities that recommend Junxure the most is the fact that it is legitimately designed by financial advisors. That means anyone who uses it for financial sales purposes is likely to feel very seen. And who doesn’t want to feel seen, by software or otherwise??

Overall, AdvisorEngine checks most of the boxes for a good CRM. It has excellent data migration and contact management, and its user interface is reported to be relatively easy.

Cons:

Reports indicate that AdvisorEngine gets out of date quickly and updates slowly. Plus, the system has a steeper learning curve than many would like. Overall, it is clunkier than some of the sleeker and more modern SaaS options listed above, such as Close. Also, its pricing structure is not transparent.

10. Salesmate

|

Salesmate is an all-encompassing cloud-based CRM software specifically designed for the finance industry to enhance productivity and boost revenue for sales, marketing, and customer service teams.

Pros:

It effectively captures leads, improves customer satisfaction, and streamlines processes, giving businesses a competitive advantage in the market.

Financial advisors benefit from Salesmate's user-friendly platform, which enables them to easily monitor leads, deals, and sales pipelines.

It offers a range of powerful features, including sales automation, marketing automation, email campaigns and sequences, built-in calling and texting, and many more.

Moreover, Salesmate's mobile CRM app ensures access to data from anywhere, allowing users to stay connected on the go.

For businesses seeking to streamline their sales processes and boost deal closures, Salesmate proves to be an exceptional choice.

Cons:

Salesmate's drawbacks include occasional slowdowns during updates, though the customer support team provides advance notice.

The email tracking feature could be more accurate, impacting email campaigns and client communication.

CRMs for Financial Advisors at a Glance

ProductProsConsMonthly Base Price Close.comExcellent all-in-one system for small, medium and big businessesNo free version, like many CRM systems, but it offers a 14-day free trial$49ZohoFree version for 3 usersHard to customize and scalePaid plans start at $14Salesforce Financial ServicesLong experience in the business and very comprehensiveExpensive to get all the features and a steep learning curve$25WealthboxSpecifically designed for financial planners and brokersPoor app updates and frequent crashes reported$45UgruAutomatically eliminates duplicate entries in the systemThe basic package is expensive and deleted items are gone forever$59NexJ SystemsImpressive client list and lots of integration potentialThe cost of NexJ is likely out of reach for most small/medium-sized businessesN/ADebtPayProWell-tailored to businesses that work on debt relief and consolidationExpensive and not well-tailored to other financial industriesN/ARedtailMade the Forbes Advisor Best CRMs of 2022 listSometimes glitchy and price is $99 a month even if you have fewer than 15 users$39AdvisorEngineDesigned by financial advisorsNo transparent pricing system$65

* Monthly base pricing structure varies by platform and may be per user or for multiple seats, and may reflect discounts for paying on an annual basis.

How to Choose the Best CRM Tools for Financial Advisors

Ready to invest in a CRM for the financial services industry? The above list is an excellent place to begin your research. We encourage you to take a look at each of the platforms we’ve noted and even test out their free trials.

But be sure to give Close a test drive, too. You’ll love how easy Close is to integrate into your current processes, and the included CRM features, like audience segmentation to make sure you’re sending the right message to the right audience, and our predictive dialers, making sales calls faster and more efficient.

Would you like to learn more about how Close can help you manage client data, find leads, and lead your sales team to victory? Try a free 14-day trial now!