What is the most appropriate and long-term strategy for expanding your SaaS business?

While acquiring new customers is the most obvious approach, most business executives believe that customer retention is the key to profitable growth while lowering client acquisition costs.

The cost of running paid ads campaigns is increasing, even as the number of people reached (or impressions) is decreasing.

Creating a brand image, generating leads, and encouraging clients to take that initial move all cost money.

All of the money, time, and effort you put into recruiting a new customer will be worthless if you don't retain customers once you’ve got them.

|

A good customer retention plan can help you build long-term relationships with your customers, who will eventually become loyal to your business.

They may even spread the word about your brand across their networks, influencing buying decisions among their friends and peers, resulting in higher growth for your company. You can think of them as brand ambassadors.

Churn rate vs. retention rate

Customer churn rate and customer retention rate are two of the most critical KPIs for SaaS companies to measure.

These are the metrics that tell you if you're onboarding the correct users, whether your product is providing a high-quality experience, and whether the features you've launched are the right ones.

Let's take a closer look at these critical metrics.

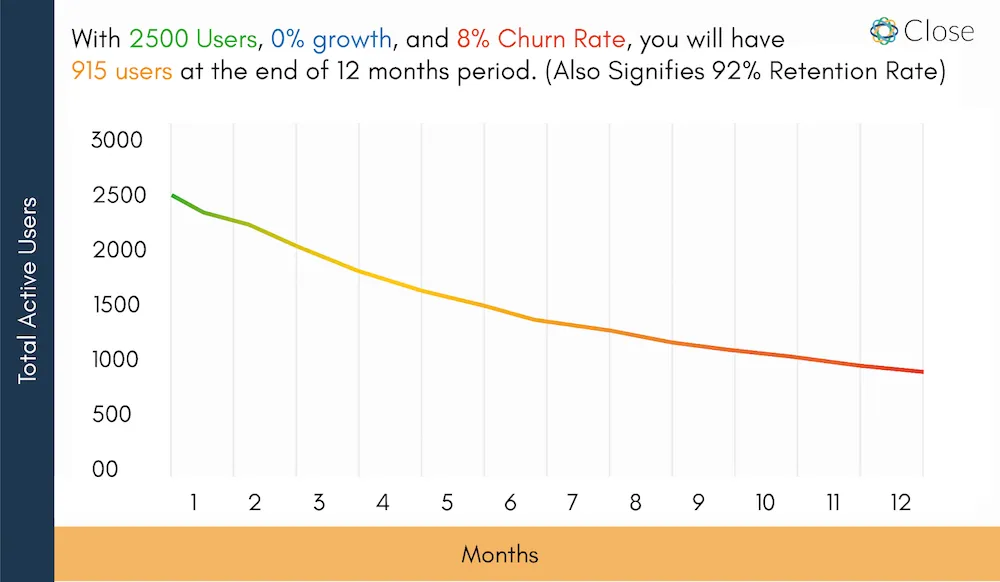

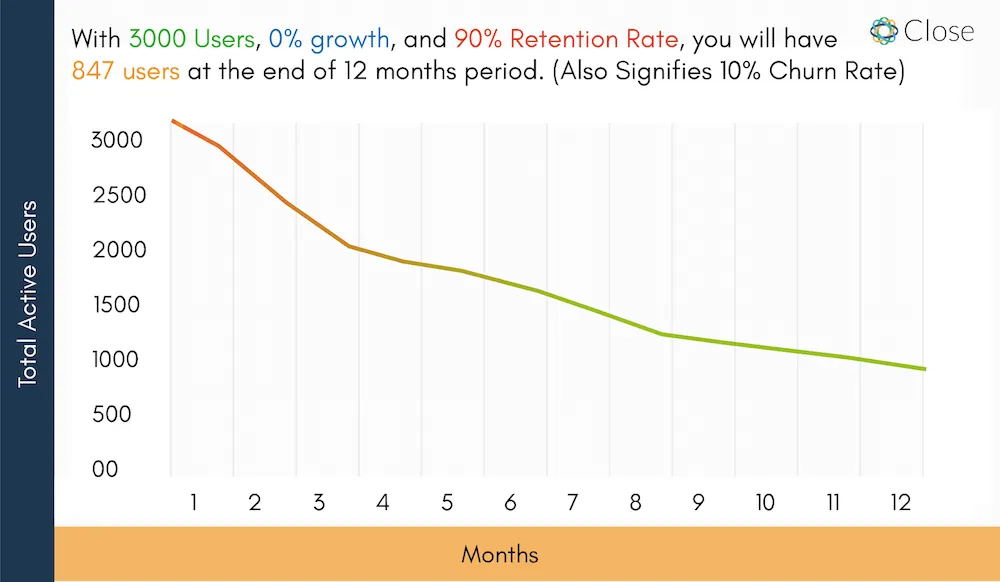

The percentage of customers who join and then leave within a set period of time is known as the customer churn rate. Customer retention rate is the percentage of customers who join up and stick with you.

Simply said, a high churn rate indicates that you are losing clients, whereas a low churn rate indicates that you are retaining customers.

|

Having a high customer retention rate and a low customer churn rate has three primary advantages.

To begin with, you're probably investing money in new client acquisition.

If you spend $100 on ads to get one $50-per-month customer, you'll need that customer for at least two months to break even and three months to make money.

You've lost $50 if the consumer leaves after the first month.

Second, a low churn rate combined with a high retention rate indicates that your consumers are satisfied with your product.

It signifies you've recognized and successfully met market demand. Now it's up to you to continue innovating so you don't lose your competitive advantage to any new entrants into the market.

|

Third, a high retention rate allows you to forecast future revenue accurately. When it comes to expanding your workforce, boosting your ad budget, and improving your features or product suite, this is critical.

A high retention rate will assure you that money will continue to flow in as you make these investments in your company's future.

How do you calculate the retention rate?

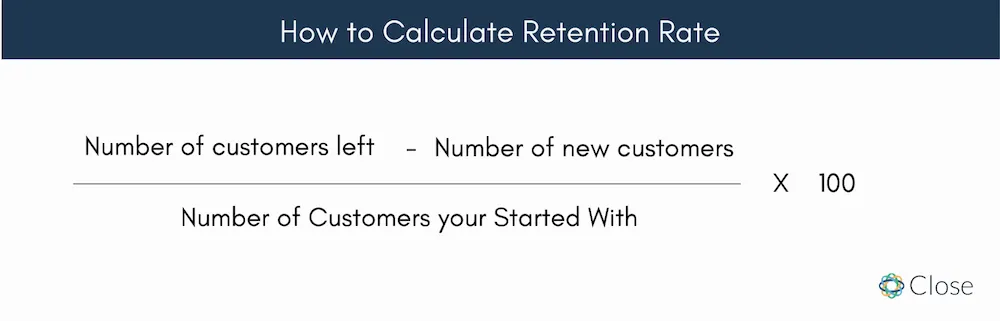

Your retention rate can be calculated using the number of customers or dollar value.

- Subtract the total number of new customers who joined during the period from the total at the end

- Divide the difference you computed above by the number of customers you began with

- To get a percentage, multiply it by 100

Let’s use an example: If you start in May with 250 customers, lose 25, and add 30, you'll end up with 255 customers. ([255-30]/250)*100, or 90%, is your customer retention rate.

|

You can calculate net or gross revenue retention if you want to measure retention in dollars.

The primary distinction is that gross revenue retention only takes into account your initial revenue as well as any losses due to churn or downgrading.

Hey you...ready to unravel the mystery behind total contract value? Start reading!

Top 10 customer retention metrics

Any contract-based or subscription-based business relies on customer retention to survive.

New subscribers are helpful, but the customers who decide to subscribe to your product month after month, year after year, are the ones that matter.

After all, attracting a new customer can cost up to four times as much as keeping an existing one.

Here are some of the customer retention metrics you need to track to be at the top of your retention game:

Revenue churn rate

This rate can be used to calculate the proportion of total income lost from existing buyers over time.

If your revenue churn rate is unstable, it signifies that some customers are on the verge of leaving your services, and you must move quickly to keep them.

The following formula can be used to compute this rate:

Monthly Revenue Churn Rate = Net monthly revenue lost from existing customers in a given period divided by total monthly revenue at the beginning of the period.

The monthly revenue rate is also referred to as MRR.

|

Revenue churn rate is a number that can help you figure out which of your products/services are underperforming and make strategic changes to your retention strategy.

Customer Lifetime Value (CLV or CLTV)

Customer lifetime value (CLV) refers to the amount of money earned from a single customer throughout their relationship with you.

This is a measure to track regularly, whether you sell individual products or services or software that is billed annually.

CLV should ideally increase or remain constant, as a decreasing CLV indicates that you're either capturing lower-value clients or losing customers at a higher rate than in the past.

|

Customer lifetime value is a retention measure that demands the addition of a few components: the average order value, number of purchases, and the average lifespan of the customer.

CLV = Average order value * Number of purchases in a year * Average customer lifespan.

This retention statistic is important because it provides the most accurate estimate of how much you should spend on acquisition expenditures.

The higher your acquisition costs must be, the larger your CLV. This allows you to refocus your marketing strategy on profitable retention techniques rather than expensive acquisition strategies.

Repeat purchase rate

This is the percentage of customers who buy from you more than once. An annual membership renewal, the purchase of an a la carte feature, or an upgrade to a premium version are all examples of "repeat purchases" in the SaaS world.

The average repeat purchase rate is between 20% and 40%. So, if yours is lower, you should investigate why customers aren't buying from you after their first transaction.

|

This metric is valuable for SaaS companies whose customers buy their products frequently or on a subscription basis, but it isn't as useful for enterprises with a long client lifecycle, such as auto dealerships.

Customer churn rate

The rate at which customers stop being paying customers is known as the customer churn rate. This could be because they have not renewed their services, have ceased purchasing your products, or have switched to a competitor.

In truth, churn is unavoidable to some extent, but if the amount is greater than 5-7 percent, you may need to investigate further.

A high churn rate indicates that your customers are dissatisfied with your product or service, and suggests that you may need to take additional measures to manage your churn rates, such as implementing a seamless recurring payment process to reduce friction.

The churn rate might help you figure out how many clients you're losing and when they're leaving. You might be able to spot some weak points in your customer engagement strategy using this data and comparing results by quarter, month, or year.

When measuring customer churn rate, omit new sales/new customers because you may lose and gain customers in the same month.

Customer retention cost

Simply described, customer retention cost (CRC) is the total of all expenditures associated with keeping a current client.

This includes all direct, indirect, and support resources used to ensure that an existing client makes another purchase.

It's not easy to figure out how much it costs to keep a customer. There isn't a universally acknowledged formula.

Total purchases over a period, retention expenditures, churn, acquisition costs, and general overhead, can be used to generate retention figures.

Net promoter score

The Net Promoter Score is calculated using your customer's response to a simple question: On a scale of 0 to 10, with 10 being the highest, what is the likelihood of you referring us to a friend or relative?

The Net Promoter Score (NPS) is one of the most insightful client retention indicators. When you look at your NPS over time, you may discover patterns such as an increase in detractors, which could suggest poor product quality or customer service.

|

Consider asking for more information if a consumer has a bad opinion of your product, service, or company. When someone from your company takes the time to listen to a disgruntled customer's problems, they may change their minds.

Remember that your promoters require attention as well. Offer them a loyalty discount or any other incentive to show how much you value them.

First call resolution (FCR) rate

First call resolution occurs when a customer calls with a query or issue and receives a satisfactory response on the first call.

Customer satisfaction is highly correlated with first contact resolution. The higher your FCR rate, the better your customer experience and the greater the lifetime value of your customers (CLV).

To improve your first call resolution, you must first customize it for your organization.

It should be tailored to the skill sets of your agents, communication channels, and organizational best practices.

|

The first call resolution rate formula can be used to quantify first call resolution. Simply divide the total number of customer cases resolved on the first outreach by the total number of cases received that day, week, month, quarter, or year to calculate your FCR rate.

Days sales outstanding (DSO)

Days sales outstanding (DSO) is a working capital ratio that measures the average number of days it takes a company to collect its accounts receivable. The shorter the DSO, the faster the company receives payment from its customers – and the sooner it can put its cash to use.

Typical DSO metrics will differ greatly between industries. However, by comparing a company's DSO to that of other companies in the same industry, some conclusions about the company's cash flow and working capital performance can be drawn.

Companies that carefully monitor this metric have a good understanding of their accounts receivable process. They can then use this information to determine the best course of action to increase the speed with which they collect invoices to meet financial obligations.

The SaaS days sales outstanding calculation simplifies cash management. Bots can perform these calculations automatically, ensuring that businesses always have access to up-to-date data.

Days sales outstanding (DSO) are calculated by dividing the accounts receivable balance by the revenue for the period, which is then multiplied by 365 days.

DSO = Average or ending accounts receivable/revenue * 365 days

Daily/weekly/monthly active users rate

An active user is one who has interacted with your company during a specific period.

DAU, which stands for Daily Active Users, is commonly used in businesses where users are expected to interact daily (eg. email, calendar, games).

WAU, which stands for Weekly Active Users, is commonly used for businesses that expect users to interact a few times a week (e.g. forums and social communities, mobile apps, productivity & analytics tools).

MAU (Monthly Active Users) is commonly used for B2B apps where users are expected to interact only a few times per month or less (e.g., accounting & bookkeeping software).

In the SaaS world, active users can be termed as someone logging into their account. However, the common types of engagement that comprise an active user can vary depending on the business sector and the business goals.

Calculating the number of active users over time allows you to evaluate the effectiveness of your campaigns as well as the customer experience your app provides.

Customer satisfaction score

A customer satisfaction score is derived from a one-question survey that collects consumer satisfaction levels.

Customers are asked to rate their satisfaction with a brand's products, services, or overall experience in CSAT (Customer Satisfaction) questions.

Customers rate their satisfaction on a scale of "extremely unsatisfied" to "extremely satisfied."

CSAT is simply the percentage of positive CSAT survey responses you receive.

|

The most common CSAT calculation attempts to determine the percentage of customers who are satisfied with your company.

Only “Very satisfied” and “Satisfied” responses are considered when performing this calculation.

To calculate your CSAT score as a percentage, divide the number of satisfied customers by the total number of survey responses. Then multiply that figure by 100.

CSAT (percentage) = (number of positive responses / total number of responses) * 100

Put these retention metrics to use

Businesses are focusing more on retaining customers than obtaining new ones; therefore, retention strategies are becoming more common.

As a result, every SaaS business owner must include these indicators in their policies and strategies.

Understanding how to track and assess these 10 retention metrics will provide you with a strategy to have a successful retention marketing strategy.

So, whether you're new to retention or a seasoned pro, you're ready to take over your industry and secure profitable consumers for years to come.

Are you struggling to identify the key drivers of your business? Value Metrics can help – read our post to find out how.