Exploring the best CRMs for insurance companies is crucial in today's data-driven world.

Since ancient times, the art of organization has been a fundamental aspect of human endeavor. The meticulous record-keeping of Mesopotamians with their cattle counts, the extensive cataloging of scrolls in the Great Library of Alexandria, and even the color-coordinated arrangement of Paris Hilton’s shoe collection, all exemplify our innate desire for order.

This is no different in the modern insurance industry, where effective management of customer relationships is key. Here, Customer Relationship Management systems, or insurance CRMs, play a vital role.

As we delve into the world of insurance CRMs, we aim to identify the best options available for insurance companies and agents in 2024. These systems are not merely tools for organizations; they are essential for managing the vast amounts of data and client interactions typical in the insurance sector.

Our exploration will highlight the most effective CRMs that can help insurance professionals streamline operations, enhance customer relationships, and drive business growth.

Let's begin our journey into the realm of the best CRMs for insurance companies, understanding how these systems can transform the way insurance professionals organize and manage their customer relationships.

Ideal CRM Features for Insurance Businesses

Insurance companies grow and succeed by building excellent relationships with prospective and existing customers. Maximizing the contact time sales reps have with them is a crucial driver of success.

Yet finding time to interact with all leads, prospects, and customers is challenging. And that’s where a CRM comes in, providing features such as:

- Automation templates: Contact your clients without actually having to do any work, relying on pre-written content

- Call software: Handle a more significant pipeline and increase your workflow with easy autodialers and other call technologies

- Integrations: Use the spreadsheets, social media channels, and apps on which you already rely, along with your CRM

- Import leads and clients in bulk: Say goodbye to time-consuming manual entry for all your clients, prospects, and leads

- Get reminders for upcoming renewals and meetings: Forget remembering important dates or sales calls when you can just input everything in the system

Compare different CRM solutions for contractors to find the one that aligns with your business goals in the contracting field.

Benefits of Insurance CRM Software

Now, look at the core functionality a good all-in-one CRM offers an insurance business. We’ll break these down into the following areas.

Lead Generation and Pipeline Management

As leads enter the sales funnel, they become part of the CRM’s lead management system. A good CRM software will take each new lead and begin them on a journey defined by the company’s sales playbook.

As the lead is qualified and becomes an opportunity, new tasks are added for sales reps. Emails are sent, calls are scheduled, etc. This continues throughout each stage of the funnel. Once a prospect becomes a paying customer, the CRM can generate new leads as new products or services become available.

Improve Sales Processes

As an insurance company leader, you may find that implementing a new CRM also presents the opportunity to think through their sales processes and make adjustments that a CRM will help streamline. Once the process runs for a while, you may recognize your sales process has too many steps or needs an extra touch point here or there. Your CRM reporting can show you where your funnel has additional bottlenecks.

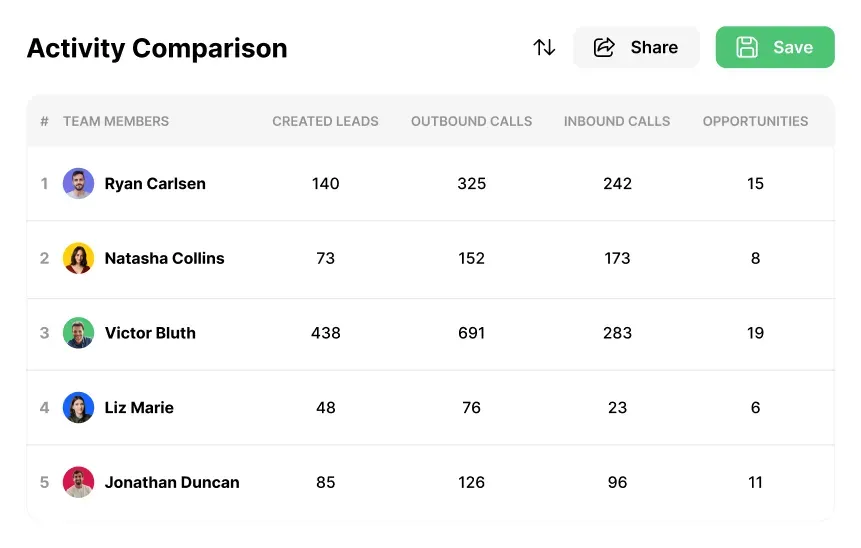

Improve Agency Management

When choosing a CRM for your insurance agency, there are specific agency management features you’ll want to evaluate. Yes, you’ll enjoy all CRM features that insurance agencies need, like commission processing, cross-selling tools, the ability to integrate multiple insurance providers and detailed policyholder information... but as an agency leader, you’ll want top-notch dashboards and reporting so you can allocate resources and make data-informed leadership decisions that affect all areas of a small business from sales teams to customer support.

|

A new CRM may require additional training to get all your team members on the same page. Still, it will ultimately make their jobs more accessible with all efficiently logged claims management records, policy information management, and application/quote correspondence.

Sales and Marketing Automation

In an all-in-one CRM, sales and marketing work together seamlessly to place a targeted marketing message in front of a customer or prospect at the right time. Thanks to workflow automation, a sales rep no longer has to remember or spend time sending out emails, as the system will automatically do so on their behalf. Reps can also set follow-up actions like automated emails or phone call reminders, so that leads stay on track as they move through the sales funnel.

How Insurance Agents Benefit from CRMs

Getting your agents onboard with a new process or new technology can be a hurdle. Nobody likes change, but you can ease the transition by ensuring your agents understand how the new CRM will directly benefit them.

The last thing most insurance agents want to be stuck doing is paperwork, yet insurance is an administrative-intensive field. Here are a few ways that your agents will benefit from CRM.

Contact Management

It’s evident that the days of Rolodexes are gone, but so are the days of a simple digital address book or contact record. A good CRM for insurance agents uses automation for contact management, keeping not only information up to date but keeping a log of every touchpoint a customer has from anyone within your agency. Ready access to customer information also allows agents to provide excellent customer experiences when they need to check on a policy or make a claim.

Improve Follow-ups

Good insurance agents don’t wait for sales to enter the door; they seek out new leads and opportunities. This means that effective reminders can be a critical element of a rep’s success. Luckily, CRMs set reminders for phone calls, email out follow-up emails automatically, and display notifications for scheduled meetings.

Did you know… With Close CRM, you can set up automated workflows. This includes templated email follow-ups sent out at specific intervals, as well as intuitive reminders when it’s time to make a call. Try it out for yourself.

|

Manage Sales Pipeline

As potential customers journey through the sales pipeline, your CRM will help insurance brokers monitor each stage for each rep in real time with regular and on-demand sales pipeline reports and dashboards.

These reports can show bottlenecks in your sales funnel, as well as each sales rep’s performance during every stage of the sales process. You can optimize lead assignments, create mentoring opportunities, and revisit best practices.

How to Choose an Insurance CRM Solution

Before your insurance agency can choose the right CRM solution, you should list all the needs and wants you and your team can come up with. Consider taking the following steps to compile a list to use when evaluating options for CRMs.

- Ask your agents for input. What do they wish their system could do? What things do they spend ‘offline’ time — that is, time not selling — that could be automated? What do they want to ensure is not automated because they feel it requires a human touch?

Pro tip: Have your agents watch our 10-minute Close CRM demo video to see some of the possibilities and get them brainstorming that way.

- Check with your underwriters about what CRMs their insurance services may integrate with or that they hear their best-performing agencies are using. Even if their services don’t have integrations built already, this is a great head start, and APIs can always be built if needed. Plus, opening those lines of communication now will help with actual implementation later.

- Work with your best agents to follow four or five clients along their sales journey from lead to closed-won. What are the key touchpoints specific to their journey for the right insurance policy, and how could a CRM help streamline those processes? Write down the features a CRM would need to do this.

- Now, look at a handful of lost sales. What could have been done by a CRM to keep them engaged? If it wasn’t a good fit, what CRM tools could be used to screen the lead better earlier in the process? Add the features needed to your list.

- Reach out to trade groups on LinkedIn and ask for reviews, feedback, and pros & cons for different solutions. Ask questions about the quality of training, technical support, and implementation assistance, including data migration. Always ask about the agency’s overall and specific metric improvements after short-term and long-term adoption.

- If your agency offers different lines of insurance, create a list of the different types and their specific needs. Automotive policies have different needs than homeowners insurance or corporate liability lines. Make sure you note any particular requirements. If your company sells health insurance, long-term or short-term disability coverage, or similar policies, note any regulatory compliance needs around HIPAA.

10 Best Insurance CRM Solutions for Insurance Companies

If there’s something that we here at Close know, it’s CRMs. There are a few different types of CRM, each offering pros and cons that will affect how your insurance agency operates. Here’s an overview:

- All-in-one CRM systems aren’t usually built explicitly for the insurance industry but offer fantastic support, training, and the ability to be easily customizable for insurance company use. They automatically integrate telephone dialers, contract and commission tracking, dynamic sales tools (such as referral management and cross-selling automation), and dynamic reporting.

- Operational CRM systems streamline and automate workflows, and focus on monitoring and optimizing customer-facing business processes such as marketing, sales, service, and billing. They may integrate third-party services but typically require you to establish contracts with multiple vendors to get the same benefits as an all-in-one.

- Marketing CRM systems work by streamlining marketing processes, including bulk email, individual email, website, SMS, social media, and sales call scheduling with existing customers. These systems are often used in tandem with a centralized CRM.

- Industry-specific CRM systems focused on agency management system functions for insurance companies tend to have good policy management tools for your agency but relatively generic, standard CRM features.

It should be noted that these cloud-based solutions typically have tiered pricing. Free CRM trials or unpaid ‘basic’ subscription levels are a great way to investigate the software, see how it functions, and ultimately decide if it’s right for your agency. However, in most cases, you shouldn’t be surprised if the needs of your insurance agency require a mid-level or higher subscription.

Here are the CRM systems that we analyzed.

1. Close

|

Close works to accelerate agent and broker output, generate quotes in a few clicks, and win more deals, including through the powerful Workflow automation feature. Its renewal engine automates the outreach process and re-quotes your clients before they can think to look elsewhere. It automates requests for referrals and manages ongoing customer relationships. It is also the only CRM on this list to fully integrate global VoIP and SMS as a standard module within its key features.

Pros:

- Trusted by insurance providers, including leaders from AAA, Allstate, Farmers, Branch, and US Health Group

- Top-ranked fastest adoption time of any CRM on the market, so you can get up and running quickly

- Free trial, migration, and support

- Integrates with DocuSign for digital contract signing/authentication

- Top-rated customer support and training

- Custom Fields and Activities make it easy to adapt Close to your specific sales process and needs

- With the Close iOS mobile app, insurance professionals can easily access their CRM data, manage leads, and communicate with clients directly from their iPhones or iPads. This level of mobility ensures that they never miss an important update or opportunity, no matter where they are.

- Additionally, the Close iOS mobile app empowers insurance agents to handle email communication efficiently. The image below showcases how emailing looks like in the Close Mobile App, displaying a user-friendly interface and streamlined functionality:

|

Cons:

- Works best with a pre-existing working knowledge of sales principles (though Close’s comprehensive blog and learning resources provide great on-demand education)

- Close pricing can seem higher than competitors until you consider the included features and support that most other CRMs only offer as add-ons.

2. Better Agency

|

Better Agency bases its value on the fact that you can easily get started with its CRM. However, they take it to the next level by promising you can take all your information with you for free if you ever leave them. Better Agency offers most of the functionality of a larger system like Close but is missing some important components.

Pros:

- Customer reporting and profiles are detailed and comprehensive

- User-friendly dashboard

Cons:

- Users report that the company focuses more on driving sales than on serving existing customers

- Additional users report some staff have limited knowledge of their product

3. Surefyre

|

Similar to the above two companies, Surefyre offers an integrative experience that combines all of the information you need to sell insurance and monitor policies afterward. It is flexible and customizable and has gotten positive reviews from most users.

Pros:

- Very in-depth functionality that does require lots of upfront onboarding

- Covers all types of insurance sales

Cons:

- The learning curve is quite steep, leading to some frustration and time on the phone with customer service

- Does not integrate with Google Drive

4. Simple CRM

Another option for insurance sales and tracking, Simple seeks to optimize the process—as the name suggests—through simplification. It is cloud-based and available on all devices but is also low-code, so you (or your team) aren’t expected to learn a bunch of new skills.

Pros:

- Super scalable solutions, powering both small and medium-sized businesses as well as global operations

- Covers the entire sales cycle, from marketing to customer service

Cons:

- Some users report a lack of responsiveness from Simple CRM’s customer service team

- Beware of contracts that may lock you into a long, paid relationship, before you’ve given it enough of a trial to know whether it’s right for you

5. Insureio

Insureio promotes itself as the CRM for insurance agencies. Under the insurance-policy sales framework, the software features the same lead management, communication, marketing, reporting, and sales tools you expect from any CRM system. The system integrates a one-page application for term life insurance, permanent life insurance, LTC, disability, and annuity providers through various integrations.

Pros:

- Prebuilt agency templates, recruitment emails, hierarchy management, and agent brand assignment

- Application completion: Electronic applications with e-signature and e-policy delivery options for over 30 carriers

- Lead-form-to-application functionality

- Pricing is per feature and not based on the number of users, so it is suitable for large agencies with lots of already-existing agents

Cons:

- Billed per feature, not per user (Some add-ons are billed per user)

- Poor activity dashboards

- Onboarding can be complicated for new agencies and those not already working with many providers.

- Autodialer integration can be complicated if not working with their preferred VoIP system (3CX)

6. AgentCubed

|

AgentCubed is a good solution for those in health insurance because it offers solutions for both insurance sales and health plans in one. You can use it to market and sell as well as track current customers’ policies and needs. Its focus on healthcare is nice if that’s your industry, but may not bring a lot of value outside that.

Pros:

- Focuses on healthcare specifically

- A complete solution with good customer support

Cons:

- Pretty clunky and basic, so probably not the best choice for those who have CRM familiarity

- Locating records is frustrating because the search function is limited

7. AgencyBloc

|

AgencyBloc is a CRM system that heavily integrates an agency management system (AMS) for life and health insurance agencies, including policy management, commission module, and integrated automation of agency functions. AgencyBloc gets the insurance agency functions well, but standard sales CRM functions are just that.

Pros:

- Good agency management features and reporting for the owner/sales manager

- Easy process for consolidating and reporting information in dashboards and reports

- Good customer service for getting things going

Cons:

- Several reviewers cited challenges with migrations from other CRMs or in-house systems

- Server reliability issues and slow response times

- Poor handling of non-standard data (for example, half-year coverage)

8. LeadMaster

LeadMaster is a SaaS-based lead management solution that captures, tracks and automates follow-up with leads. The solution combines various integrated modules for sales force automation, customer relationship management, marketing automation, and reporting.

Pros:

- Good resource and training library, documentation

- Easy access to data and expansive reports library

- Very low entry price

- Good customer service and support, including strong after-hours support

Cons:

- Difficult to use without a strong tech/programming background

- Constant glitches that lose or misfile data

- Background processes run poorly and have been described by reviewers as ‘clunky’ and ‘unpredictable.’

9. Freshsales

|

Freshsales features built-in email, phone, chat, and telephony systems and is a good solution for organizations looking to enhance their marketing automation. This CRM’s strong points are geared toward startups and small businesses, deal management, forecasting, and reporting tools. However, reviewers suggest that lead tracking and early funnel functionality could be improved.

Pros:

- All but the essential functions require paid add-ons

- Easy-to-understand user interface

- Good built-in reporting

Cons:

- Some reviewers report operational lag time, creating delays in pipeline management

- Predefined sales process phases aren’t customizable

- Long delays with customer support, especially when navigating overcomplicated processes

10. Zoho CRM

|

Zoho CRM is tailored for enterprise (100+ users) businesses. The CRM is just one application amongst a much more complex family of apps that allows for additional power and features. Zoho is ideal for organizations that can designate a dedicated CRM administrator with an IT background for purchasing and managing VoIP systems, workflow programming, and third-party services integration.

Pros:

- Relatively inexpensive per-user fees

- Includes an extensive array of business tools, not just CRM, with the Zoho Suite

- Works well if you already have many third-party integrations and are NOT looking to centralize your system into a more streamlined CRM

Cons:

- Companies must invest in dedicated employees for administration, programming, and IT support

- Poor or no tutorial videos, training, or customer service

- Requires subscription and integration of third-party apps

- Slow customer support

Getting Started With a CRM System

The advantages a dynamic and robust CRM system can have on your insurance agency are significant. The right CRM for your agency will:

- Centralize all of your contacts and log all touchpoint history in one database

- Use workflows and artificial intelligence tools for sales automation —including traditional and email marketing and ongoing customer relations

- Free up the time your insurance agents spend on administrative or technical tasks to focus on the customer, lead pipeline, and new sales

- Provide valuable information through reporting tools for agency leaders to make better-informed day-to-day and strategic decisions

We’re convinced that Close remains the top choice as a CRM for insurance agencies, and we’ve recently used our experience in sales and insurance to provide a list of ways to increase insurance sales in the digital age. But don’t just take our word for it:

|

We invite you to try out Close for a 14-day credit-card-free trial so we can show you just how easy and effective our platform can be for your business.