Pitching to investors was already scary.

Now, in 2020, the world situation makes asking for money seem even harder. Many founders wonder if they’ll really be able to convince investors to give them the funding they need.

But difficult as it may be, it’s certainly not impossible.

In fact, according to a report by CrunchBase, global venture funding in the first half of 2020 totaled $130 billion, just a 6% decrease year-over-year. Incredibly, this is still a significant increase from the first halves of 2016 and 2017.

|

The point? Investors are still giving out money: But you need to prove to them that your business is built to survive.

So, how can you prepare for a successful investor pitch? What should a pitch deck include?

By the end of this article, you’ll be fully prepared to pull off your next investor pitch with ease and grace.

We’re going to discuss:

- Mistakes some startups make when pitching to investors

- What should a pitch deck include?

- How to pitch to investors successfully: 9 best practices

Mistakes Some Startups Make When Pitching to Investors

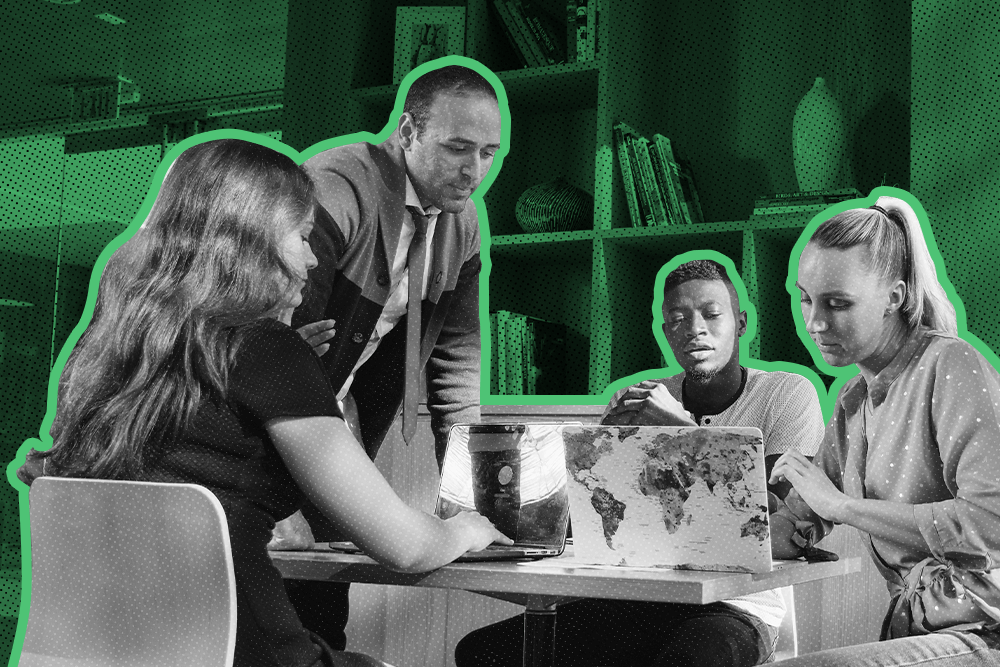

Whether you’re talking to an angel investor, VC firm, incubator, or bank, there is one common denominator: You’re not the first person who’s asked them for an investment.

These people live and breathe startups, and they look for specific signs that tell them if you’re worth investing in or not.

Especially for new entrepreneurs, it’s easy to fall into some common mistakes and be labeled as a risky investment.

What are some common mistakes startup founders make in their investor pitch?

Hanging your Pitch on Vanity Metrics

“We have 100 beta users.”

“We got 300 app downloads in just three months.”

“50 people signed up for the program just a few days after launch.”

These are all what we call vanity metrics. Just like social media followers, likes, or kudos from your mom.

These metrics tell investors nothing about the value of your solution for users, or whether or not it’s going to last.

If you don’t have better metrics to show yet, it’s probably not the right time to be asking for money. Investors are interested in the market, but they’re more interested in whether or not your business is going to thrive in the long-term

To show them how valuable your product is to users, give investors metrics that tell a story, such as:

- Conversion rates

- Monthly or daily active users

- Customer retention rates

- Monthly recurring revenue gains

These metrics show how much customers love the product, not just their initial interest.

Getting Investors Just to ‘Save the Business’

If you’re trying to raise money with a short runway, your desperation to simply ‘survive’ will show in your investor pitch.

As Caya from Slidebean says...

Nobody wants to pour money into a sinking ship.

Don’t think of an investment as your first resource to save the company. Instead, an investment should be there to help you grow your business once it’s on stable ground.

If your pitch is based around the fact that your startup won’t survive without this investment, you’ll be unlikely to get much help.

Making the Presentation Too Long or Complex

Like pretty much everyone you will ever give a presentation to, investors are busy people.

The longer your presentation is, the less likely they are to stay focused.

A good length to shoot for is about 10 minutes. Any longer, and you risk losing the interest of your investors.

But what if you feel you can’t give all the information you need to in just 10 minutes? Then you’re trying to present too much information, and investors will walk away confused.

Instead, be concise and clear. Clarity and brevity go hand-in-hand, so we can avoid investor pitch decks that look like this...

|

...and present a solution that is clearly understood by everyone involved.

Allocating Too Much Money to Founders' Salaries

When investors see a $300,000/year salary for the founder of a startup they’re investing in, that’s a red flag.

Startup founders: You can’t expect to be earning the big bucks from the get-go.

With time, your well-produced ideas will turn a significant profit. But if you expect a cushy salary paid out by investors, you’re likely to be disappointed.

Using Your Pitch Deck as a Script

Too many investor pitch decks are full of text that is too small to read. And too many startup founders end up reading all the text that’s displayed instead of talking to investors.

This is a double-sided mistake that can be easily solved: Just remember that your pitch deck and your sales script are two different things.

Sure, you need to have in mind what you’re going to say to investors when you walk in the door. But that’s what a script is for, not what a pitch deck is for.

Create a script that works alongside your pitch deck and practice it beforehand. You’ll feel calmer because you’ll know what to say, and the clear visuals in your pitch deck will add more depth to those words.

Distracting the Pitch With More Than One Product

You have dreams. Big dreams. And that’s great.

But today, you’re not selling investors on extravagant plans for the future. You’re selling them on the product you have built (or are building) as of now.

Sure, those plans for the future fit nicely on your long-term roadmap, and you can mention them in your presentation. But the main meat of your investor pitch should focus on the core product that you are producing as of today.

That way, there’s no distractions, and it’s clear to investors that you’re ready to ship a product that is good now, start earning money, and work to improve it in the future.

What Should a Pitch Deck Include?

As you create your pitch deck, how can you make sure investors are truly interested in your company? How can you get them to see the same potential in your ideas as you see?

Your investor pitch deck should include certain key slides that explain and convince investors that your idea has true value. Whatever else you include in your pitch deck, make sure these slides are there:

Problem/Solution

What does your product actually do?

Your opening slides are here to explain, first the problem, and then how your product solves that problem.

By positioning your product as a solution to a real need right from the get-go, you show investors there is a place in the market where you fit perfectly. Market validation will come later on, but this type of introduction sets the right tone for the rest of the sales pitch.

One simple way to do this is to use another popular brand as a reference, as this streaming service did in their investor pitch:

|

In one simple sentence, it’s clear what this company does and how they serve their market.

Just one note of caution: If you reference another large company, don’t do it just for the name. Make sure the company you reference has a very similar business model and that the comparison helps investors understand your company, not confuse them.

How it Works

Now that investors know what your company does, they need to know how it works.

Once again, simplicity wins: Try to condense the ‘how it works’ slide into three easy-to-digest steps.

|

Using a three-step list forces you to simplify your product and pack the most meaningful description into this slide.

Market Size

What market does your company serve? How big is that market, and what kind of demand is there for a product like yours?

This slide is all about validation: Prove with real numbers that there is a genuine demand for what you’re offering.

Traction

Now it’s time to dig into the numbers of your business. As we mentioned above, don’t hang this slide on vanity metrics like social following, signups, or downloads.

Focus on metrics that tell investors how people react to your product.

|

Monthly users, MRR, customer ROI, and similar metrics are all powerful demonstrators of real interest in your product. You could even include customer testimonials that show the value your current customers are getting from the product.

Business Model and Plans

This is not a place for vague dreams and aspirations. This slide is where you give a concrete description of what you plan to achieve.

Investors need to see how your company makes money, how much money it will make in the coming months and years, and when the company will start turning a profit.

So, describe your company’s process for turning profit. How much profit do you get per unit sold or subscription purchased? How much MRR are you seeing now? What kind of increases do you expect this year, and what are you basing your forecasts on?

While long-term plans can be mentioned in this section, don’t rest your pitch on plans that are still years away from happening. Focus on the growth you’re seeing now and how that will continue into the coming months.

Competition, and How you Compare

To know whether a company will survive or not, investors need to see who their main competition is right now, and how they stand out from that competition.

|

So, who competes in the same space as you? What share of the market do they hold? And what are the main advantages of your product over theirs?

Investment Ask

Now it’s time for the hard part: How much money are you asking for?

The key here is not to simply include your total ask: Give investors the details on where this money is going.

Adding allocation data shows investors that their money is going to be well-spent, whether it’s on development of the product, increased personnel, better marketing or sales tech (like a high-powered startup CRM), or other relevant spend.

Team

This slide is more than just a glimpse at who’s involved in the company: This is a place to include further proof that your product is set up to succeed.

As a startup founder, you chose the team you have for a reason. What makes these people so special? Why are they so qualified to work at your startup? How do they individually contribute to the success of the business?

In this slide, prove to investors that your team is the A-Team of the startup world and that you are ready to crush it.

How to Pitch to Investors Successfully: 8 Best Practices

You’ve got your pitch deck ready to go, but the nerves are still making your knees wobble a little.

Want some extra prep before you walk through those doors and start pitching? Check out these 8 best practices that will help you give a truly killer startup pitch.

1. Add a Narrative to Your Investor Pitch Deck

Stories speak to your audience and help them remember what you’ve said. That’s not something we just made up: Neuroscientific research has shown that stories stimulate the brain and even change how people act in life.

The brain, it seems, does not make much of a distinction between reading about an experience and encountering it in real life; in each case, the same neurological regions are stimulated.

So, tell a story with your investor pitch.

A great example of this is the well-known Brightwheel investor pitch as seen on Shark Tank:

Dave used a very relatable narrative to show the problem that his product would solve, giving even more meaning to his pitch from the get-go. This pitch got Brightwheel a serious investment, plus he raised over $30 million in the following 2 years.

In short, stories are a powerful tool for your investor pitch.

2. Use Real Numbers

Vague ideas and guestimations have no place in your investor pitch.

|

[Source]

To have enough confidence to invest in your product, investors must see genuine validation with real numbers. If you’re using charts or graphs, include numbers and text that give a quick understanding of the data you’re presenting.

|

[Source]

Whether you’re talking about market size, company revenue, or growth, using real numbers adds meaning to an otherwise vague and unconvincing pitch.

3. Make it Pretty

While it may not seem like a big deal, having a visually appealing, well-designed pitch deck can help you in the long run.

After all, a pitch deck that looks nice shows investors you’re organized, you care enough about this meeting to present something that took some time and effort to create, and (hopefully) your product will look just as nice.

4. Be Transparent and Honest

If you feel like there are certain aspects of your business that you need to hide from investors, you probably shouldn’t be there in the first place.

Transparency is always the best policy when it comes to giving an investor pitch. In the end, whatever you try to sweep under the rug will probably be uncovered anyway, and the fact that you hid it will ruin your reputation and chances of getting an investment.

Give an honest valuation of your company. Explain in clear terms the profits you expect to make. If your company is losing money right now, tell them. When you explain your weak spots along with solutions or clear plans to improve, you alleviate the minds of investors and show them you’re working to better your product as you move forward.

Our CEO, Steli, believes that sometimes you should bring up weaknesses of your offering in your sales pitches. And the same is true for your startup pitches.

Worried that your honest pitch just isn’t going to cut it for investors? Instead of trying to frame your pitch around what you think investors want to hear, play to your strengths. Focus your pitch on the real, measurable strengths of your company, and you’ll build a convincing pitch.

5. Keep All Data and Team Information Up-To-Date

Asking for an investment can take time, and may take several meetings with different investors.

As time goes on, the situation of your startup and the people who work there may change. When this happens, make sure you update your pitch deck. Investors don’t want to see your MRR from two years ago. Give them information from today.

6. Project Realistic, But Bold Outcomes

Yes, this may seem contradictory.

As we said above, transparency will help you with your investor pitch. But don’t underestimate the potential of your startup.

You are an entrepreneur. You have dreams. And you have the vision and the spunk to go get ‘em.

Your bold vision and gumption are what will convince investors that you have what it takes to build a successful startup. So, get investors to see that vision.

7. Send Your Pitch Deck Before the Meeting

While you need to be prepared for the meeting, investors like to be prepared as well. If your pitch deck is easy-to-scan and digest, investors will appreciate the extra time to prepare for your meeting and get to know your company a bit before you walk in the door.

As a note, make sure to send the deck either as a PDF or another easy-to-access format so that investors can see it without having to jump through hoops.

8. Expect Questions and be Ready to Answer Them Calmly

If you go into your investor meeting unprepared for questions, then it will be far too easy to react defensively to the questions investors have.

For these people to offer you their money, you need to prove your idea and business are worthwhile. While you do your best to include the most important points in your pitch deck, they will still have questions.

How you answer these questions will affect their view of you and your brand.

Check out this example of an investor pitch as seen on Dragon’s Den:

Right after the pitch was finished, the investors hammered these co-founders with questions that weren’t always easy to answer. However, the pair responded calmly, allaying the fears of the investors, and finally got the funding they were looking for.

Think about the kind of questions investors may ask you. Talk to other startup founders who have asked for funding and see what investors asked them. Make a list of these common questions, and write down possible answers you could give.

When you’re prepared for these questions, you’ll be better able to answer them calmly, without going on the defensive.

Crush Your Next Investor Pitch With a Deck that Sells

Pitching to investors is scary. But with the right attitude, good preparation, and a killer pitch deck, you’ll be ready to go into that room and pitch confidently to investors.

|

Want to make your pitch deck really pop? Download our free templates to see what an investor pitch should look like, get guidance on what to include, and customize the template for your next investor meeting.